**Title: Economic Headwinds: Housing Depreciation Sparks Unprecedented 3.7% Contraction in Household Assets**

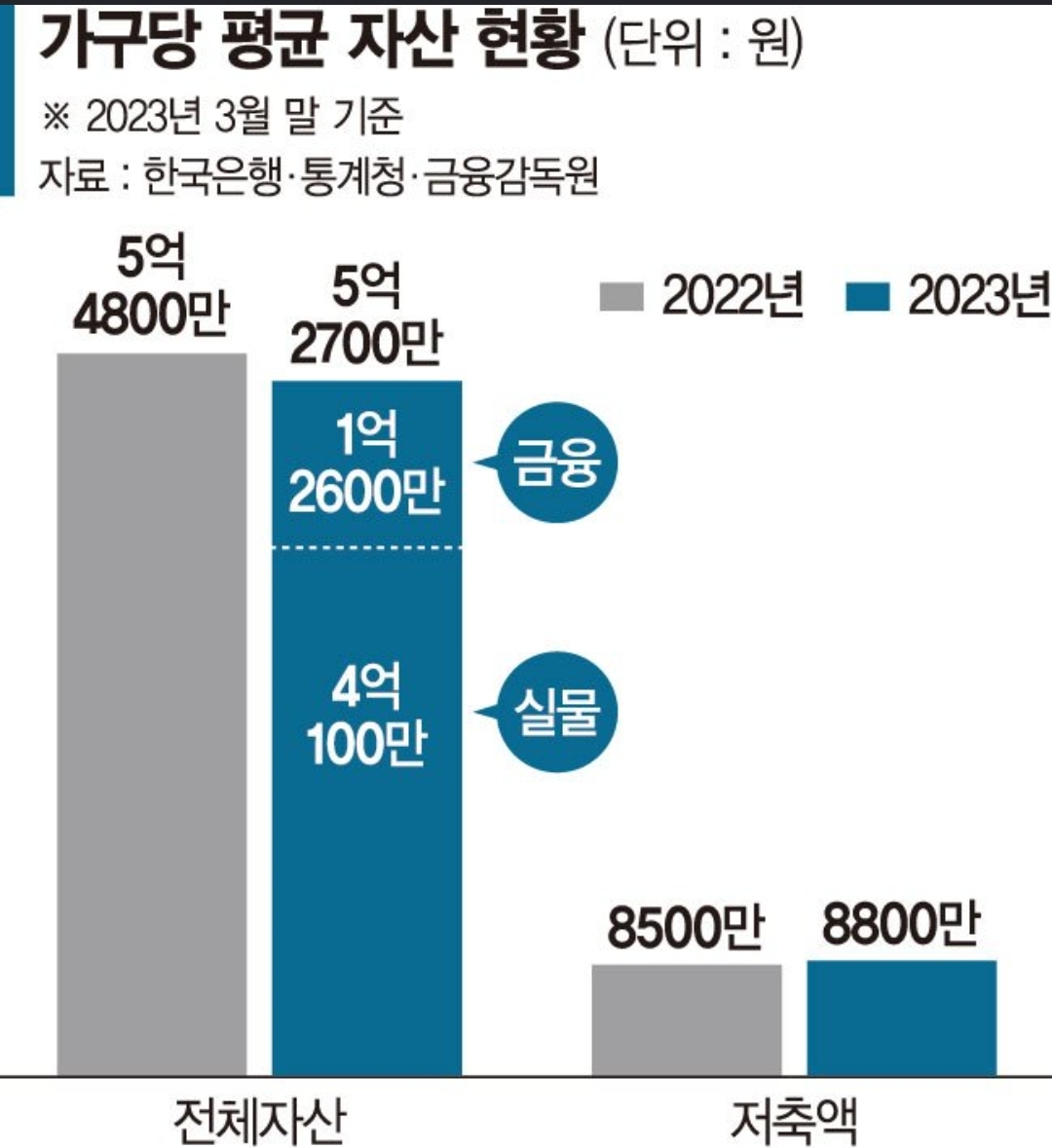

In a groundbreaking revelation unveiled by the 2023 Household Financial Welfare Survey, the economic fabric of households is undergoing a seismic shift, with average assets experiencing an unparalleled decline, settling at KRW 527.27 million. This distinctive downward trajectory represents an unprecedented contraction, signaling a departure from historical growth trends and prompting a closer examination of the intricate dynamics influencing household finances nationwide.

The primary catalyst behind this substantial dip is the palpable 10% reduction in residential property values, inflicting a 3.7% blow to the overall average household wealth. This decline, unprecedented since the initiation of statistical tracking, paints a stark picture of the challenges faced by families navigating the current economic landscape, particularly within the real estate sector.

In contrast, while household debt has marginally increased by 0.2 percentage points, reaching an average of KRW 9.186 million, it remains crucial to contextualize this uptick within the broader economic environment characterized by persistently high-interest rates. The historically low rate of debt growth underscores the resilience of households amid challenging financial conditions.

A salient revelation stemming from the survey is the alarming surge in interest expenses, with households grappling with an average of KRW 247 million in interest payments. This eye-watering 18.3% year-on-year increase in interest costs presents a significant constraint on both the income and expenditure capacities of households, amplifying the financial challenges they face.

Analysts are unequivocal in attributing the financial strain to the palpable stagnation in the real estate market, which has not only led to a 3.7% reduction in average assets but also precipitated a cascade effect, influencing disposable income and amplifying the burden of interest payments. As households grapple with these multifaceted challenges, stakeholders and policymakers alike are closely monitoring developments, seeking nuanced strategies to navigate and potentially mitigate the impact of these economic headwinds on the financial stability of families nationwide.

'일상 뉴스' 카테고리의 다른 글

| 한국 스타벅스, 급성장 속 '세계 4위' 등극 및 커피 문화 확산 (16) | 2024.02.12 |

|---|---|

| 휴게소 음식 트렌드, 뜻밖의 1위 '아메리카노'로 주름 잡다! (14) | 2024.02.11 |

| Elementary school also suffered from low birth rate_400,000 people will collapse (60) | 2023.12.03 |

| Decoding Winter Itch: Distinguishing Between Psoriasis and Dry Skin (63) | 2023.12.02 |

| 한국 여성, 조기 폐경과 심혈관 질환 위험: 새로운 시각이 필요한 이유 (58) | 2023.11.30 |